Take Control of Your X-Mod

Take Control of Your X-Mod

The Experience Modification(x-mod). Without a doubt one of the most significant impacts you can have on your overall insurance costs and often one of the most overlooked pieces as well. Year after year insureds will look forward to the tree care class code(0106) going down due to the industry getting safer. For example, over the last few years, the rate in Wisconsin has decreased from around 12% of total payroll to just under 10%. That is almost a 20% decrease! Sorry to the folks in other states dealing with higher rates, BUT, there is a way you can impact your worker’s compensation cost by more than 20% and that is by taking control of the experience modification.

What is it?

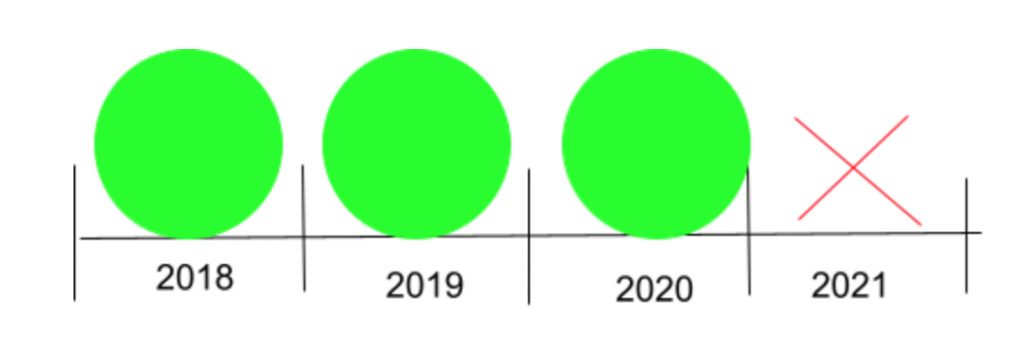

The experience modification looks back at your last 4 years of worker’s compensation experience and disregards the most recent year to allow time for claims to develop/close out. See example below for 2021 experience modification:

The rating, which is typically below, at, or above 1, is essentially a comparison of your business versus the insurance industry’s expectations for a business in your class code. If you’re below one, you’re doing better than the average tree care company and if you’re above one, you’re doing worse than expected. That number is then multiplied by your overall premium to calculate your worker’s compensation cost.

What does it look at?

We must first understand what the experience modification looks at in order to take control of it. In short, the mod looks at three major areas:

- Company Size and Class Code

Larger companies will have more payroll and therefore more potential for lower x-mods. If your company has $2 million in payroll and only has 1 $5,000 claim, your experience modification will be lower than a company who has $200,000 in payroll and also has 1 $5,000 claim with the same class code.

2. Frequency Vs. Severity

Per the National Council on Compensation Insurance(NCCI), the x-mod calculation recognizes that the cost of an accident is much less predictable than the fact that an accident happened in the first place so frequency impacts the x-mod more than severity. I.E. 10 small claims of $5,000 would impact your x-mod more heavily than 1 big claim of $50,000.

3. Claim Status

In the past you may have heard us reiterate the importance of getting your employees back to work as soon as possible. I encourage you to check your state’s specific rules, but oftentimes you can get your employee back to work on light duty to avoid the claim becoming a “lost time claim”. The x-mod reduces medical only claims, a claim where the employee does not receive lost wages and only has medical bills paid for, by 70% in comparison to a lost time claim.

It also looks to see whether a claim is still open or not. Open claims will impact your x-mod at a higher rate than closed claims. Be sure to follow up with your work comp carrier to ensure that claims are getting closed out on time.

What Can You Do?

Managing your x-mod can obviously be a very detailed task. Work closely with your agent to ensure you’re doing the best you can based on your claim history. Below are a few quick pieces you can look at to control your x-mod as best as possible.

- Implement a safety program, including regular safety meetings.

- Start a safety committee

- It may be helpful to have specific members of your business responsible for the x-mod rating. An x-mod rating is a good way to measure the effectiveness of your safety committee.

- Injury Reporting/Return to Work Program

- Claims don’t always happen often. Your company NEEDS to have an injury reporting program so employees and staff know what to do in the case of an injury. On top of that, you should have a light duty program to give to the doctor detailing what kind of work is available to the employee if they are on restrictions.

- Accident Investigation

- Having an accident investigation program is particularly helpful for mitigating the number of claims. Make sure your staff is reviewing the what and why for accidents so you can prevent them from happening in the future.

- Claim Management

- Have someone in your office responsible for managing injuries after they happen. Make sure all the information is shared with your work comp company and that the employee is back to work as soon as possible. Again, make sure the claim gets closed out once everything is settled.

- Annual Review

- Especially if you are a larger company, make sure you are reviewing your x-mod with your agent at the end of the year. This is a good way to make sure you’re on top of any claims that did occur and nothing slipped through the cracks.

Some of the best experience modifications I’ve seen are as low as .70. As you can probably tell, the companies with lower x-mods also get better rates and potential for better dividends. That means you’re looking at more than a 30% discount on your overall worker’s compensation costs! If you have any questions on how the experience modification works, or questions regarding your rating specifically, feel free to reach out to an ArboRisk team member. There are also some good resources detailing the experience modification calculation on the NCCI website. Thanks for reading and good luck getting control of your x-mod!

Written by: Malcolm Jeffris, CTSP

Recent Comments