Why Insurance is Not

Risk Management

Written by Eric Petersen, CIC

Video by Mick Kelly

“I practice risk management. I buy insurance.”

It’s staggering how many times I hear that phrase and unfortunately it is equivalent to “crown raising is a great structural pruning method.”

Simply put, insurance is NOT risk management. Insurance is a part of a successful risk management program, but should never be considered to be your entire source of risk management. Just like crown raising may be a part of the structural pruning, it is by far not the only aspect to properly pruning a tree.

There are five steps to the risk management process and, as an arborist, you subconsciously use these steps every day in the field. Sadly, because many tree care company owners are not programmed to consciously think about these five steps, they miss some of these steps when looking at their own business. This article is meant to help you apply the risk management process to your business so you are not left relying solely on insurance to protect all of the hard work you’ve put into your business.

1. Risk Identification – It starts with understanding the potential risks: what could possibly go wrong? The identification of potential risks can be done a number of ways; a few examples are by using checklists, surveys, or interviews with employees and other industry professionals.

As an Arborist – The visual inspection of a tree and surrounding property to determine what equipment you need for the job and what potential problems you may incur when working on that tree.

As a Business Owner – Think about your physical property, liability concerns to other people, your internal team and the business’ income to identify where the exposures are in your business.

2. Risk Analysis – For each risk that was identified, what is the likelihood of it actually happening and how severe of a situation will it cause? The frequency and severity of your risks will help you understand where to spend your time and money in preventing these risks.

As an Arborist – Based on the particulars of the job, you begin to set up the jobsite in your mind. How will you minimize damage to the lawn and set up the work site? Which tree needs to be worked on first to have the project go smoothly?

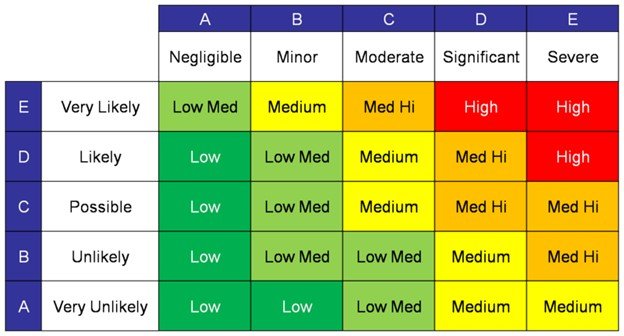

As a Business Owner – For each of the risks that you have identified, ask yourself, if this happened, how much would it impact my business? Making a Risk Map, where you put Severity on the top and Frequency on the side, will help you focus on the risks that will disrupt your business the most.

3. Risk Control – Once you know the likelihood and potential severity of your exposures, you need to create a plan to control those risks. Each risk can be addressed either by avoiding it all together, retaining the exposure or assuming the loss yourself, reducing the loss by trying to prevent it from happening, or lowering the impact by being prepared before it happens and transferring the risk to someone else. Spoiler Alert: Insurance doesn’t come into the picture until you want to transfer your risk to someone else!

As an Arborist – Before you start your job, conduct a job briefing with your crew, discussing all of the particulars of the job. That briefing is the risk control method of preventing an accident from happening by talking everything through before you start the work. It also serves as a way to reduce the impact of an accident by being prepared before something happens. If weather conditions change you can stop the job and avoid an injury or accident from happening. These are all examples of Risk Control techniques that you use every day.

As a Business Owner – Your goal is to minimize the risks to your company at the optimal cost. Installing or strengthening your safety program is a great risk control method. Creating a hiring and recruiting plan to employ the very best employees can limit the potential for employee issues or lawsuits. Understanding your company’s financial strength and where you can self-insure or retain the small things that come up everyday is critical in this step.

4. Risk Financing – We finally get to the point in the process where we talk about insurance! The decision as to how the risk will be paid for is made. Do you want to assume the risk and control it some way or do you want to buy insurance?

As an Arborist – You either decide what extra equipment or labor is needed to get the job done safely, or you decide to assume the risk of something happening with less crew members and/or not the right equipment. Your decision can be influenced by the availability of your insurance coverage and deductibles, however, whichever way you decide to perform the job is an example of risk financing.

As a Business Owner – When looking at your Risk Map, most tree care owners are willing to self insure or assume the financial risk of the low severity incidents. Anything that is in green in the above chart typically is self insured. The yellow and red items are things that pose a greater risk to your business’ overall financial health. Insurance is purchased for these risks.

5. Risk Administration – The last step in the risk management process happens after all of the planning and decisions have been made and when the plan is implemented. Part of this step is also to assess the effectiveness of your actions to improve upon your overall plan in the future.

As an Arborist – You perform the job and take mental or physical notes on how to do the job better in the future. These personal experiences are crucial for minimizing your risk on similar jobs in the future.

As a Business Owner – You begin to implement the plan by focusing on the largest impact risks first and what to do with them. Then move to lesser exposures that your business faces. All the while you want to assess how you are doing in each area in case you need to make adjustments.

Focusing on true risk management within your business will give you the ability to confidently plan and budget for the uncertainty as well as become more profitable because you have reduced the cost of accidents and injuries. Insurance should be part of this process, but should NOT be relied on as the only method of risk management.

Because working with tree care companies is all that we do, contact ArboRisk to have one of our team members help you create a solid risk management plan. Also, check out our New Heights Thrive Risk Management Package – this structured program can help grow your business and take your company to new heights!

Recent Comments